The world is going on the path of becoming fully digital, and hence, newer technologies are being introduced to regulate this digital world. One such technology is Blockchain Technology. In just a few years, this blockchain technology has captured a market size of approximately 3 billion USD in the year 2020 and is expected to increase to 39.7 USD in the next five years.

But, what is the reason for this rapid demand for technology?

Blockchain technology is a ledger that keeps all the recorded information of transactions and tracking of assets. The advantage of this technology is that all the information is stored in a way in which it cannot be changed, removed, or hacked. This keeps the information secure and reliable.

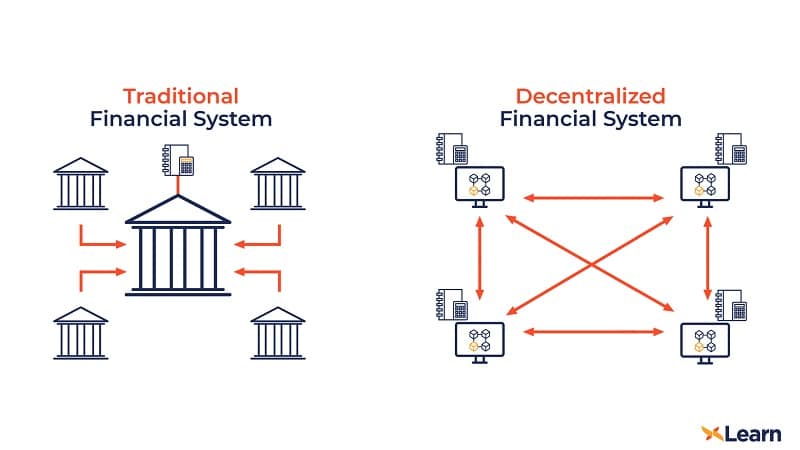

Blockchain underpins a financial system, DeFi, which has changed the traditional financial systems of relying on centralized financial intermediaries like insurance companies, banks to peer-to-peer encryption.

Interesting, right? Read the full article to know how DeFi will be a boon for Fintech Industries.

What is the Concept of Decentralized Finance (DeFi)?

Decentralized Finance is commonly known as DeFi. It is a new financial system that works on the principle of operating independently and not depending on centralized intermediaries.

This software has eliminated the involvement of traditional financial institutions like banks, insurance agencies, and credit unions and promotes peer-to-peer alternatives. DeFi uses Blockchain technology for a simple transaction to complex dealing securely.

What’s Wrong With The Traditional Finance System?

The traditional finance system is centralized with a central bank controlling overall financial activities. This means that there are intermediaries in every financial activity. Which results in slow and costly financial services. The transaction is not transparent and one has to deal with the intermediary one on one for any service.

In the traditional financial system, it needs stipulated space and time where they can operate, while the DeFi system can be operated from anywhere and just needs an internet connection.

The traditional financial system is not accessible to those who do not meet the criteria of opening a bank account while no such discrimination works in DeFi. Lastly, being centralized and not peer-to-peer encrypted, the traditional financial system is prone to hack and data theft.

How Do DeFi Works?

As we already know, that the Decentralized Financial system works independently without any financial institution as an intermediary. Hence, it needs peer-to-peer alternatives. This system works on DeFi cryptocurrency called Ethereum and smart contracts.

Ethereum can create decentralized systems for its users that can be used for several functions and most commonly for the financial system. Here at Ethereum, there are a number of Decentralized Financial applications that exist where transactions of billions take place every day.

DeFi uses smart contracts that work as Ethereum accounts for all the financial transactions and trade. It can hold funds and send, receive or refund them according to certain conditions. This smart contract cannot be altered and will always run as programmed.

How Can DeFi Help Fintech Industries?

DeFi is definitely a better option than the traditional financial system. But not only this,it is also providing valuable products and services that are completely new to the system and are beneficial for Fintech industries.

1. Lending & Borrowing

The principle of DeFi to work independently has led to peer-to-peer lending and borrowing solutions with benefits to both the counterparties.

The non-involvement of intermediaries has resulted in a fast and cheaper transaction with quick settlement and larger control on one’s assets.

2. Savings

Due to its benefits, DeFi applications are gaining great popularity. This popularity has led to the opening of new ways of savings for users. Users can lock their crypto assets to the lending pools and earn interest on them.

The double advantage of savings and earning interests through lending protocols is called ‘yield farming’.

3. Tokenization

It is Blockchain technology’s most important trend. Tokens are digital assets that have properties. They are of different types like security tokens, like digital shares providing fractional ownership on physical properties. Another type can be utility tokens which are specific to particular Decentralized Finance apps.

4. Transparent Transactions

A decentralized financial system does not have intermediaries in its financial system. Hence, the transactions that take place between two parties are transparent.

The secure and unchangeable protocol of smart contracts ensures safe transactions and is fully transparent for counterparties.

5. Stablecoins

Stablecoins are crypto tokens fixed into stable assets. These stable are often linked with currencies like US Dollar or other ones that can also be crypto tokens or commodity tokens.

Stable coins are beneficial for Fintech industries as it reduces the unstable price of cryptocurrency and proves Blockchain system advantageous for financial transaction.

Top Usecases of DeFi

1. Currencies Without Volatility

Cryptocurrency is not gaining a lot of popularity because of its volatility of prices going high and low within seconds. Through DeFi, people can enjoy the benefits of cryptocurrency without the worry of price volatility.

Stablecoins is a type of cryptocurrency which is asset-backed. These assets can range from physical commodities to gold, oil, currency. Hence, stablecoins are a viable payment solution globally.

2. Decentralized Exchanges & Liquidity Pools

DeFi through Blockchain technology provides decentralized exchange. Now, one might think that decentralized exchange platforms are only for trading cryptocurrency. That’s not true, when you have no centralized body in the transaction there is no one to control your assets and no risk of market manipulation.

Liquidity pools, on the other hand, provide users with the opportunity to put their tokens in smart contracts to ensure efficient trading, and, beneficially, users can earn interests from their holdings.

3. Assets Management

Decentralized Financial platforms have the greatest advantage in that users now have more control of their assets. Because of an intermediary like insurance institutions or banks, the control on one’s assets is lost.

Many Decentralized Financial projects are offering users the opportunity to manage their assets that include buying, selling, and transferring digital assets. DeFi allows users to keep their sensitive information private and only users have access to their assets and information.

Some Fintech Companies That Are Adopting DeFi System

MakerDAO

MakerDAO is a decentralized autonomous organization that works on Blockchain technology. It provides DAI, a stable coin, a first cryptocurrency that works against pricing volatility. It also provides a smart contract named Maker Protocol for transactions. The company works as the alternative to centralized institutions in the traditional finance system but is not controlled by any government or authorities.

UniSwap

Uniswap is a decentralized finance platform that aids peer-to-peer transactions of digital assets. It provides easier and cheaper transactions to its users. It is a tool for the users to be able to do transactions without any platform charges and intermediaries.

SetProtocol

SetProtocol is one of the top decentralized finance apps which is used for creating and managing protocols for the exchange of digital assets. It is a decentralized asset management service that groups the crypto-assets into tokenized baskets. Hence, allowing users to use multiple assets as one. It also helps in structuring and managing these baskets.

Compound

It is a lending and borrowing decentralized finance app.Users can use Compound as a lending platform for their assets to a lending pool where they are available for other users to borrow. The lenders can share the interest that the borrowers give to the pool. The earning interests are based on the amount of contribution to the pool.

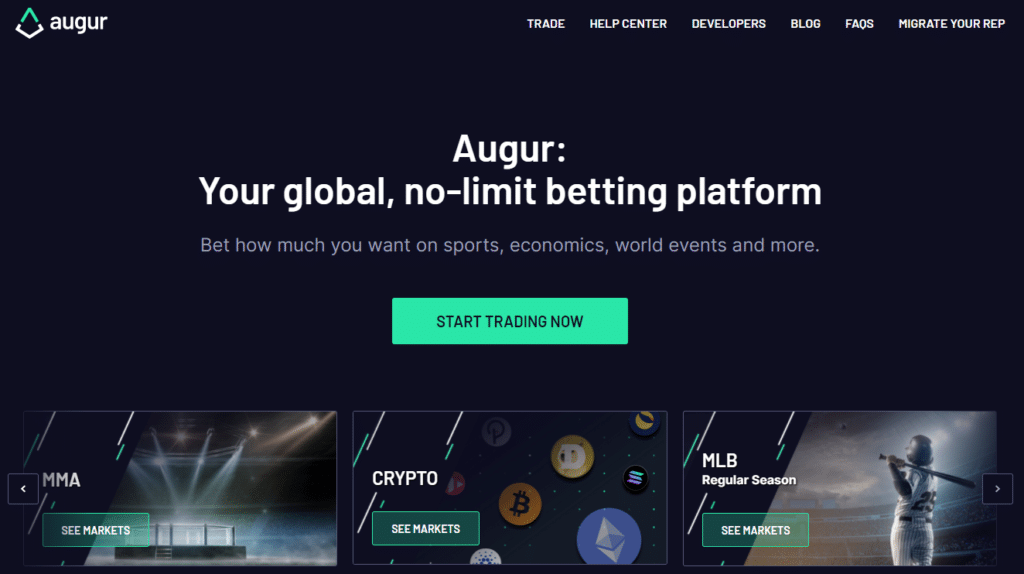

Augur

Augur is Blockchain-based, decentralized prediction market software. It allows users to create a prediction market on any topic from anywhere, which cannot be modified. It is a global and no-limit betting platform.

Conclusion

Decentralized Finance is proving to be a newer generation financial system with varied products and services that are helping users with easier, cheaper, secure transaction and trading solutions whenever and wherever they want.

It is benefiting the Fintech industry by lessening the risk of digital money and maximizing the advantages through Blockchain technology. DeFi providing such beneficiaries is definitely on its rise and promises a future for itself and the Fintech industry.